Home >> Customized >> Customized Project

Customized Project

classifyCustomized read0 date2024-09-30

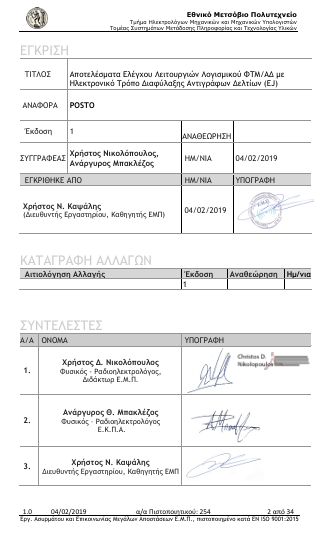

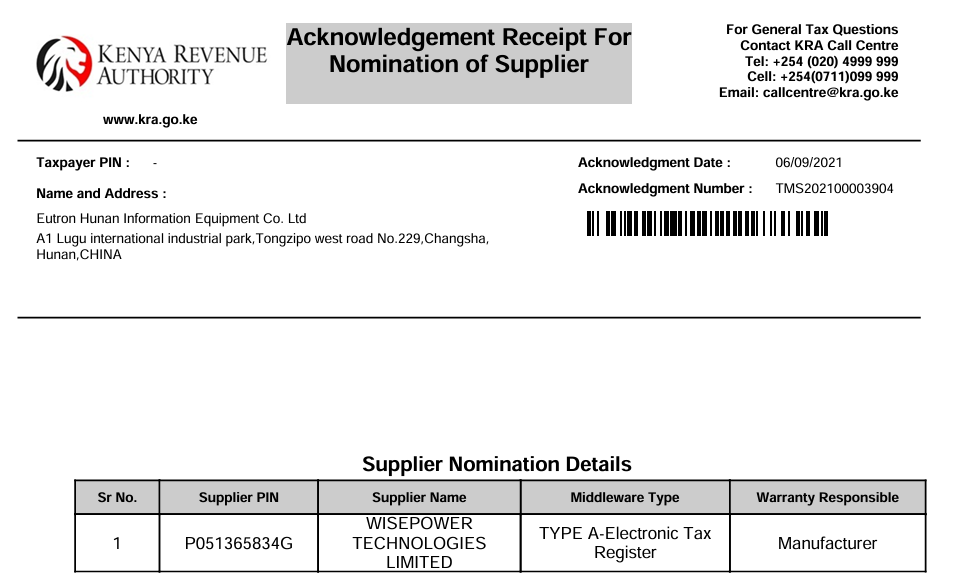

Since its establishment in 1998, Eutron's products such as ER220, ER260, ER260F, ER260G, ER520G, ER520D, MCR30F, ECR100 (F), and MCR007F, including ordinary cash registers, tax controlled cash registers, POS machines, and peripheral accessories, have successively passed the approval of local finance departments and obtained market access certificates in more than 30 countries around the world, including Greece, the Philippines, Israel, the United States, Panama, the United Arab Emirates, and Malaysia. Since then, the products have been continuously updated and received numerous praises from suppliers and users.

Taxation is the most important form and source of public finance for a country (government), and its importance is self-evident. Since 1988, Greece has become one of the first fiscal countries to obtain financial data from sales receipts and upload it to the financial department for supervision. More and more countries are implementing tax control equipment to ensure stable, safe, accurate, and orderly collection of various tax amounts.

Since 2018, Unisoc has been providing stable and continuous supply of tax controlled cash registers to countries such as Greece that manage their finances through tax control equipment. They require that the equipment comply with specific standards set by regulatory agencies

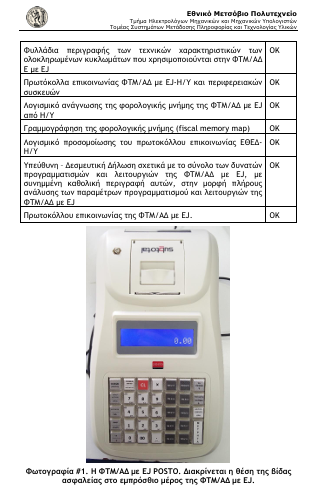

1. Cashiers with tax controlled storage: In order to ensure secure recording of every transaction, Greek cash registers are required to have tax controlled data storage. Reliable measures are taken in both hardware and firmware for tax control data to prevent data loss, alteration, and erasure.

2. Having a tax controlled printer: A professional printer is an essential part of generating receipts that comply with Greek financial regulations. The hardware in the financial printer integrates a unique tax control serial number into each receipt.

3. Including signature devices: The hardware of signature devices plays a crucial role in certain transactions. Each receipt is accompanied by a unique signature generated through a built-in algorithm, which verifies the bill to comply with Greek fiscal law.

4. Provide real-time reports: The tax controlled cash register needs to send real-time report transactions to the tax server according to the time interval set by the Greek financial server. It extracts data from working memory and provides accurate and timely information that is crucial for compliance.

5. OTA cloud update: Tax controlled payment machines are required to be able to connect with enterprise cloud servers, detect new firmware and tax rate changes in a timely manner, and perform self updates and data backups

6. EFTPOS communication: The tax controlled cash register requires the ability to connect with numerous EFTPOS, initiate card payments through ECR, complete transactions through EFTPOS card swiping, and return settlement data and types to ECR. ECR then sends relevant tax control data to the Greek financial server.

7. Backend setting software: Quickly configure or backup various parameters of the tax controlled cash register through serial port or network connection.

...

Harmony between hardware, firmware, and software is crucial in the complex fiscal laws of different countries. Enterprises operating in accordance with these fiscal laws must use compliant equipment to address this situation, ensuring transparency, accountability, and compliance with fiscal regulations. With the development of technology, the synergy between these components will continue to play a key role in creating a robust financial environment for enterprises. The fiscal solution will always follow the fiscal laws of each country, but will be more innovative.